B.Arch.; M.Urban Design (Berkeley, USA). Principal, Planning & Design Services at Design Atelier, Architects Urbanists, New Delhi, India.

Eco-Architecture

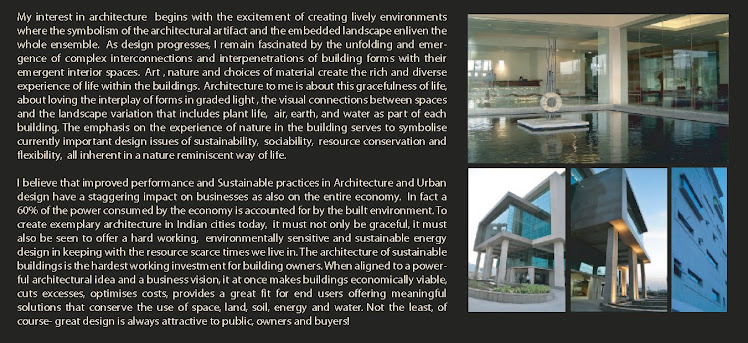

Eco-Architecture experiment- "Athena", Gurgaon, India

Thursday, June 24, 2010

Wednesday, June 23, 2010

Carbon Offsets- Did you know

Carbon offsets

From Wikipedia, the free encyclopedia (Redirected from Carbon offsets)

A carbon offset is a financial instrument aimed at a reduction in greenhouse gas emissions. Carbon offsets are measured in metric tons of carbon dioxide-equivalent (CO2e) and may represent six primary categories of greenhouse gases. One carbon offset represents the reduction of one metric ton of carbon dioxide or its equivalent in other greenhouse gases. (Wind turbines near Aalborg, Denmark. Renewable energy projects are the most common source of carbon offsets.)

There are two markets for carbon offsets. In the larger, compliance market, companies, governments, or other entities buy carbon offsets in order to comply with caps on the total amount of carbon dioxide they are allowed to emit. In 2006, about $5.5 billion of carbon offsets were purchased in the compliance market, representing about 1.6 billion metric tons of CO2e reductions.

In the much smaller, voluntary market, individuals, companies, or governments purchase carbon offsets to mitigate their own greenhouse gas emissions from transportation, electricity use, and other sources. For example, an individual might purchase carbon offsets to compensate for the greenhouse gas emissions caused by personal air travel. Many companies (see list[3]) offer carbon offsets as an up-sell during the sales process so that customers can mitigate the emissions related with their product or service purchase (such as offsetting emissions related to a vacation flight, car rental, hotel stay, consumer good, etc.). In 2008, about $705 million of carbon offsets were purchased in the voluntary market, representing about 123.4 million metric tons of CO2e reductions.

Offsets are typically achieved through financial support of projects that reduce the emission of greenhouse gases in the short- or long-term. The most common project type is renewable energy, such as wind farms, biomass energy, or hydroelectric dams. Others include energy efficiency projects, the destruction of industrial pollutants or agricultural byproducts, destruction of landfill methane, and forestry projects.[5] Some of the most popular carbon offset projects from a corporate perspective are energy efficiency and wind turbine projects.

Carbon offsetting has gained some appeal and momentum mainly among consumers in western countries who have become aware and concerned about the potentially negative environmental effects of energy-intensive lifestyles and economies. The Kyoto Protocol has sanctioned offsets as a way for governments and private companies to earn carbon credits which can be traded on a marketplace. The protocol established the Clean Development Mechanism (CDM), which validates and measures projects to ensure they produce authentic benefits and are genuinely "additional" activities that would not otherwise have been undertaken. Organizations that are unable to meet their emissions quota can offset their emissions by buying CDM-approved Certified Emissions Reductions. Offsets may be cheaper or more convenient alternatives to reducing one's own fossil-fuel consumption. However, some critics object to carbon offsets, and question the benefits of certain types of offsets. Offsets are viewed as an important policy tool to maintain stable economies. One of the hidden dangers of climate change policy is unequal prices of carbon in the economy, which can cause economic collateral damage if production flows to regions or industries that have a lower price of carbon - unless carbon can be purchased from that area, which offsets effectively permit, equalizing the price.

From Wikipedia, the free encyclopedia (Redirected from Carbon offsets)

A carbon offset is a financial instrument aimed at a reduction in greenhouse gas emissions. Carbon offsets are measured in metric tons of carbon dioxide-equivalent (CO2e) and may represent six primary categories of greenhouse gases. One carbon offset represents the reduction of one metric ton of carbon dioxide or its equivalent in other greenhouse gases. (Wind turbines near Aalborg, Denmark. Renewable energy projects are the most common source of carbon offsets.)

There are two markets for carbon offsets. In the larger, compliance market, companies, governments, or other entities buy carbon offsets in order to comply with caps on the total amount of carbon dioxide they are allowed to emit. In 2006, about $5.5 billion of carbon offsets were purchased in the compliance market, representing about 1.6 billion metric tons of CO2e reductions.

In the much smaller, voluntary market, individuals, companies, or governments purchase carbon offsets to mitigate their own greenhouse gas emissions from transportation, electricity use, and other sources. For example, an individual might purchase carbon offsets to compensate for the greenhouse gas emissions caused by personal air travel. Many companies (see list[3]) offer carbon offsets as an up-sell during the sales process so that customers can mitigate the emissions related with their product or service purchase (such as offsetting emissions related to a vacation flight, car rental, hotel stay, consumer good, etc.). In 2008, about $705 million of carbon offsets were purchased in the voluntary market, representing about 123.4 million metric tons of CO2e reductions.

Offsets are typically achieved through financial support of projects that reduce the emission of greenhouse gases in the short- or long-term. The most common project type is renewable energy, such as wind farms, biomass energy, or hydroelectric dams. Others include energy efficiency projects, the destruction of industrial pollutants or agricultural byproducts, destruction of landfill methane, and forestry projects.[5] Some of the most popular carbon offset projects from a corporate perspective are energy efficiency and wind turbine projects.

Carbon offsetting has gained some appeal and momentum mainly among consumers in western countries who have become aware and concerned about the potentially negative environmental effects of energy-intensive lifestyles and economies. The Kyoto Protocol has sanctioned offsets as a way for governments and private companies to earn carbon credits which can be traded on a marketplace. The protocol established the Clean Development Mechanism (CDM), which validates and measures projects to ensure they produce authentic benefits and are genuinely "additional" activities that would not otherwise have been undertaken. Organizations that are unable to meet their emissions quota can offset their emissions by buying CDM-approved Certified Emissions Reductions. Offsets may be cheaper or more convenient alternatives to reducing one's own fossil-fuel consumption. However, some critics object to carbon offsets, and question the benefits of certain types of offsets. Offsets are viewed as an important policy tool to maintain stable economies. One of the hidden dangers of climate change policy is unequal prices of carbon in the economy, which can cause economic collateral damage if production flows to regions or industries that have a lower price of carbon - unless carbon can be purchased from that area, which offsets effectively permit, equalizing the price.

What are Carbon Offsets/ Credits

Bunch of facts cobbled together on Carbon Offsets

Carbon offsets, called Certified Emissions Reductions, are issued under the U.N.'s Clean Development Mechanism, which is designed to reward investors in clean energy projects in developing nations. CERs are internationally tradeable and major buyers are big European polluters which can use the offsets to meet mandatory emissions reductions under the EU's emissions trading scheme. The carbon trading scheme, is meant to penalise heavy polluters and reward those who reduce their emissions, currently gives out large numbers of “allowances” to companies for free, which can then be sold for cash on the open market.

Following are some details about India's carbon market.

SIZE AND VALUE

Out of the 421 million CERs issued to date by the United Nations body governing the CDM scheme, India has received 79 million and China 207 million. Of these, an estimated 10 million CERs issued to Indian projects remain unsold, analysts say. The CDM market was worth $2.7 billion in 2009, comprising part of a global carbon market totalling $144 billion that year. The market is dominated by the EU's emissions trading scheme. CERs currently trade around at 13 euros each.

NUMBER OF PROJECTS AND PROJECT TYPES

A total of 513 Indian CDM projects have been formally registered by the U.N. governing panel. Nearly another 800 are in the development pipeline, either proposed or awaiting auditing before being registered and then issued with CERs after a final round of verification. China has 873 projects registered out of a total project pipeline of more than 2,100. In total, there are more than 5,000 projects in the CDM pipeline of which 2,253 have been registered.

As of the beginning of June, India had projects developed or planned:

-- Wind power: 380 (6,020 megawatts total capacity)

-- Biomass: 303

-- Energy efficiency: 251

-- Hydro: 144 (6,352 megawatts planned)

-- Destruction of hydrofluorocarbon HFC-23: 8

Of the more than 220 registered Indian projects to have received CERs, four are HFC-23 projects and these are responsible for about 50 million of the 79 million CERs issued to date.

HFC-23 is an industrial byproduct and a powerful greenhouse gas. Europe is a top buyer of HFC-23 offsets, although severe criticism of these projects means investors are looking to develop more renewable energy resources instead.

INDIA VERSUS CHINA

India allows unilateral development of CDM projects. That is, private investors or large firms take on all the costs and risks of designing, developing and verifying a project to ensure it meets the U.N.'s rules to be registered and earn CERs. In return, project owners have much greater flexibility in choosing when and at what price to sell their CERs.

Chinese projects must have a buyer and a seller before any investment can proceed, meaning the CERs are generally pre-sold before formal registration.

DEMAND FOR INDIAN CERs

According to the NGO Sandbag, which monitors the EU emissions trading scheme, 21.4 percent of the 77.9 million CERs for 2009 EU ETS compliance came from India. This was down from 31 percent (25.3 mln) of the 81.5 mln CERs surrendered in 2008. The vast majority were CERs from Indian HFC-23 projects.

MAJOR CONCERNS FOR INVESTORS

Several. The CDM is a key part of the U.N.'s Kyoto Protocol climate pact and nations have yet to agree on the shape of a successor treaty to Kyoto after its first phase ends in 2012. While it's generally believed the CDM will continue in some form after 2012, the exact rules are unclear and it is unlikely all CERs will be accepted in the EU ETS or other national emissions trading schemes. The U.N. is under pressure to ban HFC-23 projects or sharply discount the number of CERs issued from them. A flood of cheap CERs from HFC-23s has dominated the CDM to date and any tightening of the rules could slash the number of CERs available to buyers.

(Source: The United Nations Framework Convention on Climate Change, UNEP's Risoe Centre, the Carbon Rating Agency)

Carbon offsets, called Certified Emissions Reductions, are issued under the U.N.'s Clean Development Mechanism, which is designed to reward investors in clean energy projects in developing nations. CERs are internationally tradeable and major buyers are big European polluters which can use the offsets to meet mandatory emissions reductions under the EU's emissions trading scheme. The carbon trading scheme, is meant to penalise heavy polluters and reward those who reduce their emissions, currently gives out large numbers of “allowances” to companies for free, which can then be sold for cash on the open market.

Following are some details about India's carbon market.

SIZE AND VALUE

Out of the 421 million CERs issued to date by the United Nations body governing the CDM scheme, India has received 79 million and China 207 million. Of these, an estimated 10 million CERs issued to Indian projects remain unsold, analysts say. The CDM market was worth $2.7 billion in 2009, comprising part of a global carbon market totalling $144 billion that year. The market is dominated by the EU's emissions trading scheme. CERs currently trade around at 13 euros each.

NUMBER OF PROJECTS AND PROJECT TYPES

A total of 513 Indian CDM projects have been formally registered by the U.N. governing panel. Nearly another 800 are in the development pipeline, either proposed or awaiting auditing before being registered and then issued with CERs after a final round of verification. China has 873 projects registered out of a total project pipeline of more than 2,100. In total, there are more than 5,000 projects in the CDM pipeline of which 2,253 have been registered.

As of the beginning of June, India had projects developed or planned:

-- Wind power: 380 (6,020 megawatts total capacity)

-- Biomass: 303

-- Energy efficiency: 251

-- Hydro: 144 (6,352 megawatts planned)

-- Destruction of hydrofluorocarbon HFC-23: 8

Of the more than 220 registered Indian projects to have received CERs, four are HFC-23 projects and these are responsible for about 50 million of the 79 million CERs issued to date.

HFC-23 is an industrial byproduct and a powerful greenhouse gas. Europe is a top buyer of HFC-23 offsets, although severe criticism of these projects means investors are looking to develop more renewable energy resources instead.

INDIA VERSUS CHINA

India allows unilateral development of CDM projects. That is, private investors or large firms take on all the costs and risks of designing, developing and verifying a project to ensure it meets the U.N.'s rules to be registered and earn CERs. In return, project owners have much greater flexibility in choosing when and at what price to sell their CERs.

Chinese projects must have a buyer and a seller before any investment can proceed, meaning the CERs are generally pre-sold before formal registration.

DEMAND FOR INDIAN CERs

According to the NGO Sandbag, which monitors the EU emissions trading scheme, 21.4 percent of the 77.9 million CERs for 2009 EU ETS compliance came from India. This was down from 31 percent (25.3 mln) of the 81.5 mln CERs surrendered in 2008. The vast majority were CERs from Indian HFC-23 projects.

MAJOR CONCERNS FOR INVESTORS

Several. The CDM is a key part of the U.N.'s Kyoto Protocol climate pact and nations have yet to agree on the shape of a successor treaty to Kyoto after its first phase ends in 2012. While it's generally believed the CDM will continue in some form after 2012, the exact rules are unclear and it is unlikely all CERs will be accepted in the EU ETS or other national emissions trading schemes. The U.N. is under pressure to ban HFC-23 projects or sharply discount the number of CERs issued from them. A flood of cheap CERs from HFC-23s has dominated the CDM to date and any tightening of the rules could slash the number of CERs available to buyers.

(Source: The United Nations Framework Convention on Climate Change, UNEP's Risoe Centre, the Carbon Rating Agency)

Tuesday, June 22, 2010

Sustainability Questioned

Sustainability is high on the agenda of public debate, but the variety of interpretations of what this term actually means is bemusing. They range from idiosyncratic definitions to “greenwashing”, or giving a veneer of sustainability to buildings, products and services that are definitely not environmentally sound.

Certification systems like LEED, BREEAM and DGNB are aimed at bringing more transparency to the business of rating sustainability. They claim to cover and assess all the aspects of sustainability that are relevant to buildings. But precisely this is what some architects are sceptical about: Once these schemes are introduced, will all those other qualities of a building be neglected – the ones that can’t be expressed in figures?

How sustainable are constructions made of timber or timber-based products? What impact is climate change having on building design? or How do you go about planning a zero-carbon city in the desert of Abu Dhabi? Are some buildings too expensive and exclusive to qualify as sustainable?

Or do such labels simply broaden the way people look at architecture?

Certification systems like LEED, BREEAM and DGNB are aimed at bringing more transparency to the business of rating sustainability. They claim to cover and assess all the aspects of sustainability that are relevant to buildings. But precisely this is what some architects are sceptical about: Once these schemes are introduced, will all those other qualities of a building be neglected – the ones that can’t be expressed in figures?

How sustainable are constructions made of timber or timber-based products? What impact is climate change having on building design? or How do you go about planning a zero-carbon city in the desert of Abu Dhabi? Are some buildings too expensive and exclusive to qualify as sustainable?

Or do such labels simply broaden the way people look at architecture?

Energy Efficiency

Schneider Electric suggests 4 sustainability steps offer a way to achieve successful energy efficiency:

1- Measure energy use to identify potential savings and malfunctions

2- Install low consumption equipment and systems

3- Improve long term use by deploying automation management, consulting, training and tracking resources while maintaining high performance.

4- Continuously analyse energy savings through maintenance, supervision and monitoring.

1- Measure energy use to identify potential savings and malfunctions

2- Install low consumption equipment and systems

3- Improve long term use by deploying automation management, consulting, training and tracking resources while maintaining high performance.

4- Continuously analyse energy savings through maintenance, supervision and monitoring.

Monday, June 21, 2010

Frank Gehry's interview on the truth about his views on LEED

Frank Gehry stirred up controversy last month when he reportedly called LEED — an internationally recognized green building certification system – “bogus stuff” and that green building had become “fetishized,” like wearing an American flag pin.

Check out his interview here to find out what he really thinks about green building, the LEED certification process and the future of sustainable architecture.

Check out his interview here to find out what he really thinks about green building, the LEED certification process and the future of sustainable architecture.

Tuesday, June 15, 2010

A Case for Green Entrepreneurship

Aashish V. Karode, B.Arch.; M.U.D. (Berkeley)Principal, Planning and Design Services

Design Atelier Architects – New Delhi

Design Atelier Architects – New Delhi

Email: akarode@da-urbis.net

Current scientific research across the globe suggests today that it would be prudent to remove 80 percent of the carbon from the economy by 2050. As an architect that designs buildings and company townships, helping businesses achieve sustainable environments that are economically viable, are attractive to buyers and tenants through great end user solutions that optimize the use of energy and water, I should be very excited to learn that improved performance in architecture and urban design could add considerable value, given that 60% of the power/water consumed is accounted for by cities and of that 60% of power by the air-conditioning of buildings.

Using conservative design methods, a potentially staggering impact on the power-water consumption of the country could result if effective ways are found to support change in products and processes across the built environment. Imagine if buildings could be designed to be used through the day without electrical lights, or to run air-conditioning needs on pre-cooled recycled water or to use all natural and paid resources conservatively and then say multiply this model to the entire city to gauge the impact. In the United States, statistics suggest that that for every 1 calorie of consumption, 9 calories are used in production. In comparison, Russia has a ratio of 1:1. It is obvious from here that it is imperative to address these issues, even if simply to achieve a simple long term competitive advantage. Several years ago, the BMW Group, issued a Sustainable Value Report detailing energy consumed, water consumed, waste removed, and volatile organic compounds per vehicle produced. Scoring high in all these categories, BMW today believes that its reputation as the world's "greenest" car company plays an important role in brand awareness and customer satisfaction, factors that contribute to its revenue growth.

Current scientific research across the globe suggests today that it would be prudent to remove 80 percent of the carbon from the economy by 2050. As an architect that designs buildings and company townships, helping businesses achieve sustainable environments that are economically viable, are attractive to buyers and tenants through great end user solutions that optimize the use of energy and water, I should be very excited to learn that improved performance in architecture and urban design could add considerable value, given that 60% of the power/water consumed is accounted for by cities and of that 60% of power by the air-conditioning of buildings.

Using conservative design methods, a potentially staggering impact on the power-water consumption of the country could result if effective ways are found to support change in products and processes across the built environment. Imagine if buildings could be designed to be used through the day without electrical lights, or to run air-conditioning needs on pre-cooled recycled water or to use all natural and paid resources conservatively and then say multiply this model to the entire city to gauge the impact. In the United States, statistics suggest that that for every 1 calorie of consumption, 9 calories are used in production. In comparison, Russia has a ratio of 1:1. It is obvious from here that it is imperative to address these issues, even if simply to achieve a simple long term competitive advantage. Several years ago, the BMW Group, issued a Sustainable Value Report detailing energy consumed, water consumed, waste removed, and volatile organic compounds per vehicle produced. Scoring high in all these categories, BMW today believes that its reputation as the world's "greenest" car company plays an important role in brand awareness and customer satisfaction, factors that contribute to its revenue growth.

Similarly, building a sustainable society requires societal expectations from government and businesses grow to include their green credentials- that governments and businesses be committed to sustainable strategies. In fact, many of the environmental challenges we face are a result of assuming that environmental goods and services like electricity, air-conditioning , emissions, are cheap, and water, wastes, or topsoil are free. Activities undertaken by businesses that enhance their value in society and thus benefit their reputation and brand will create a win-win for the business and its larger group of stakeholders. Today, increasing social expectations regarding a business's commitment to sustainability will ensure that ignoring this will entail a business risk.

In practice there are enormous barriers that organisations face in making efficient use of resources or investing in sustainable technologies. Of the major barriers is first, that they doubt the technologies and the thinking can deliver returns and what they cost in comparison to the conventional technology. The second is that they think customers won't support the change because the current product at currently affordable prices is satisfactory. The third is that they imagine a negative impact on revenue if more capital is required to implement energy and water savings. And the fourth is they don't want to change the way their process already runs. But this change is about building a commitment to a sustainable society. It is symbolised by contributing to a sustainable strategy that will create value for the country over the long term. Just as Indian businesses have learnt to optimise capital and labour for cost savings and have got so very good at optimising them, now they should have an additional ethical obligation to practice their businesses with a lighter environmental touch.

Today what we need to learn to do is optimize the use of energy and water. There are enormous opportunities in tightening up processes to transform the built environment, in particular through how we deal with energy. It is a massive undertaking, and it is going to touch nearly every aspect of our lives, but it is also going to be an incredible source of opportunity for entrepreneurial activity.

Thursday, June 3, 2010

Subscribe to:

Posts (Atom)